For further information on how this can help you, or for any other Business Central thoughts, contact your Inside Account Manager.

Tips and Tricks

Reconciling Corrections to Bank

It’s happened to everyone. You’ve posted an incorrect transaction involving the bank. The incorrect transaction never actually hit the bank in real life, and the mistake has since been reversed in Business Central. Now all the dollars and totals are correct. Phew!

But in the Bank Account Ledger Entry (BALE), we see the original mistake and the correction, both as unreconciled (ie Open). Given that the original mistake and the correction never actually hit the bank, they will never appear on a Bank Statement from the bank.

How can these two transactions be removed / ignored from Business Central’s Bank Reconciliation process?

Model 1

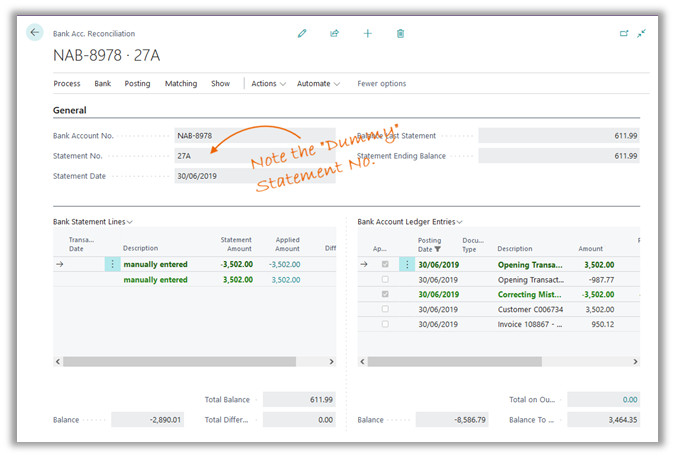

In the earlier versions of Business Central, you would raise a “dummy” reconciliation, manually entering the mistake and correction in the Bank Statement Lines (left hand side), and then reconciling them to the BALE records (right hand side).

That process still works today and has validity because it isolates the two transactions into their own reconciliation. But by today’s standards, it would probably be seen as cumbersome, and unnecessary.

Model 2

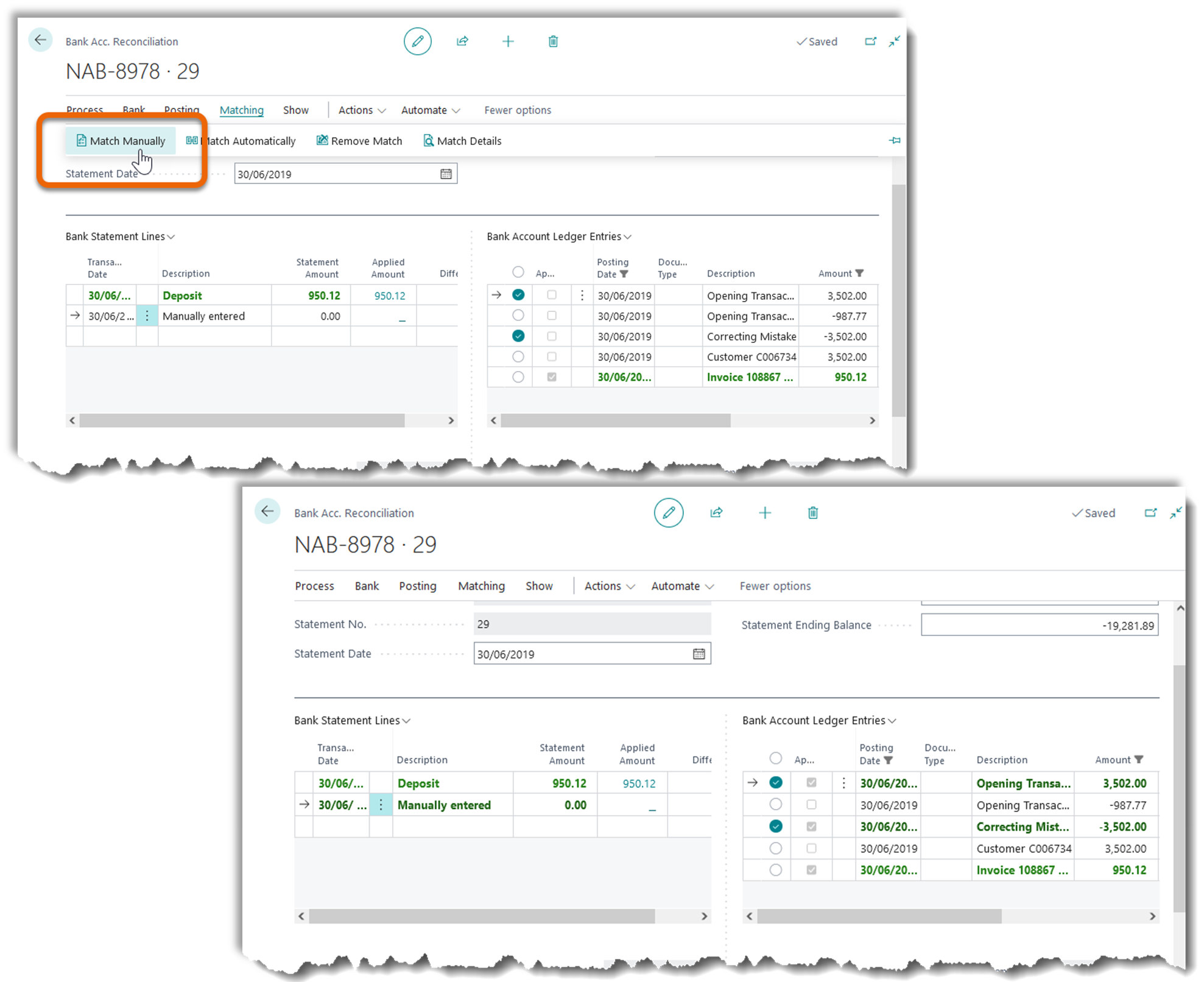

In later versions of Business Central, a single Bank Statement Line (left hand side) can be matched to multiple BALE records (right hand side). As part of your normal bank reconciliation process, select a Bank Statement Line, and simply match it to:

- It’s real BALE record (right hand side).

- Any other mistake-and-correction BALE records (right hand side).

This only works if all the Amounts of the mistake-and-correction BALE records total zero.

In the example pictured below, a single deposit of 950.12 can be matched to it’s “partner” in the BALE, and “…just we can close it off…”, we also match it to the mistake-and-correction BALE records. It is as if we’re adding the mistake-and-correction as “tag along” reconciliations to this one.

The totals don’t change, and the resultant Bank Statement is entirely accurate.

Model 3

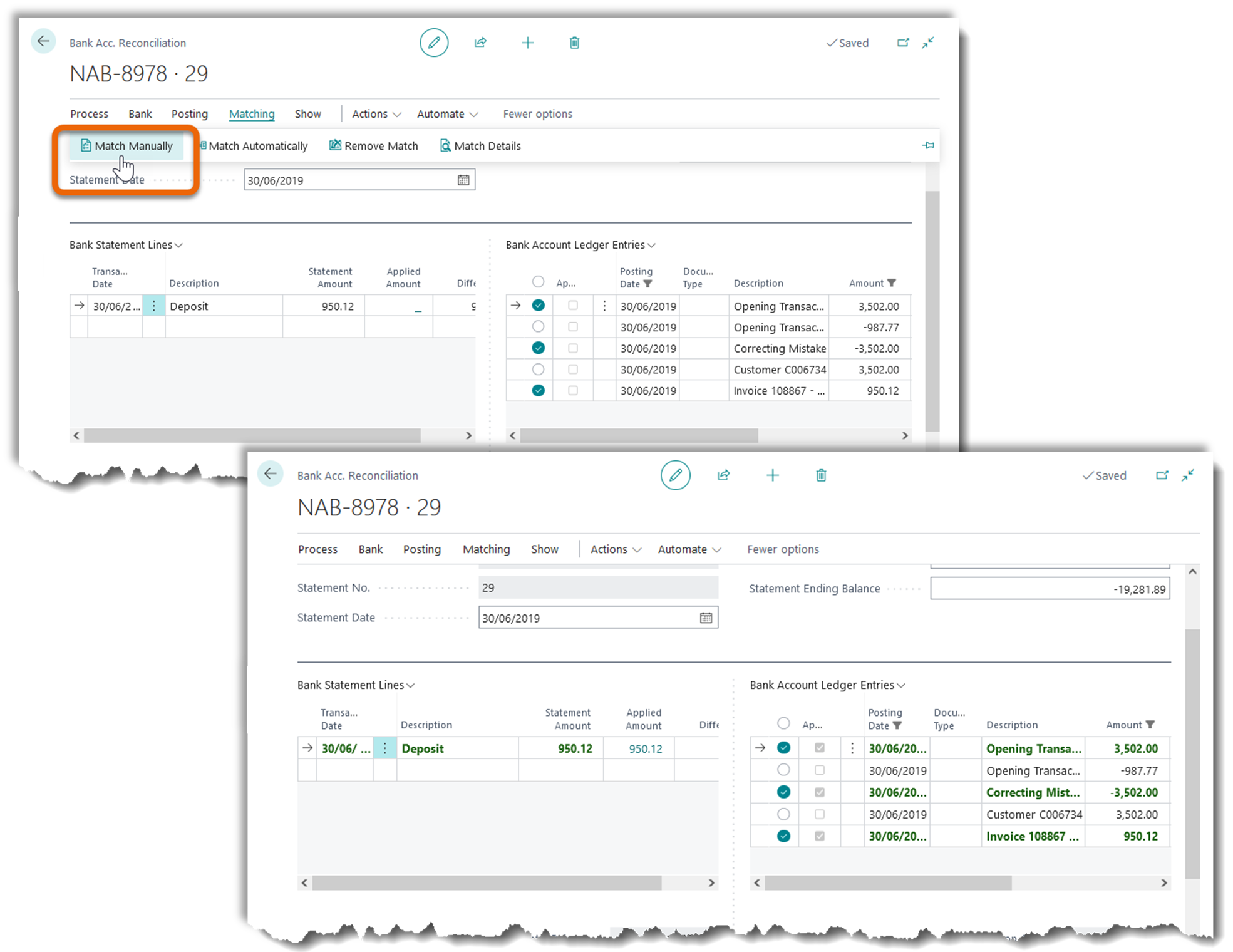

Some organisations like to totally isolate the Bank Statement Lines used to reconcile mistake-and-correction BALE records—they don’t like the “tag-along” model from Model 2 (above).

Simply undertake your regular automatic bank reconciliation, and then add an extra line on the left hand side of the reconciliation. Enter a meaningful Description and zero as the Statement Amount, and then do a manual match of one-to-many.

As before, the totals don’t change, and the resultant Bank Statement is entirely accurate (even with an extra line, but it will have a meaningful Description).