For further information on how this can help you, or for any other Business Central thoughts, contact your Inside Account Manager.

Tips and Tricks

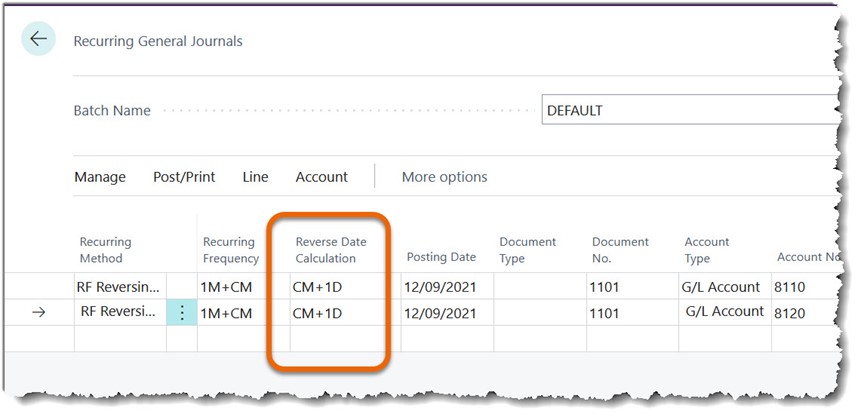

Reverse Date Calculation

Business Central’s Recurring General Journals are one of the most popularly used tools in the suite. They are the primary tool when posting similar amounts on a regular frequency. Within Recurring General Journals themselves, one of the most used features is the ability to reverse the posted amount: this is how Business Central handles accruals. By setting the Recurring Method to any of the ‘reversing’ methods (Reversing Fixed, Reversing Variable, Reversing Balance, Reversing Balance by Dimension), Business Central will reverse the posted amount the day after the journal’s Posting Date.

That is the important concept: Business Central reverses the posted amount one day after the Posting Date.

- If the Posting Date is the last day of the month, the reversal will happen one day later, on the first day of next month.

- If the Posting Date is the 15th of the month, the reversal will happen one day later, on the 16th of the month.

But by using the Reverse Date Calculation field, you can specify exactly how much later the reversal will occur. It uses Business Central’s standard “date formula”. Here are some examples:

- Reverse Date Calculation is “1D”, Business Central will do the reversal one day after the Posting Date (this is the default).

- Reverse Date Calculation is “1M”, Business Central will do the reversal exactly one month after the Posting Date.

- Reverse Date Calculation is “CM+1D” Business Central will do the reversal on the first day of the month after the Posting Date. In the example in the picture, the reversal will take place on 1st

Clever use of the Reverse Date Calculation could mean that you can even reverse the postings in the next year! If you set Reverse Date Calculation to “CY+1D”, Business Central will reverse the figures on the first day of the next year.

As you can see, the power is also in the clever use of Business Central’s date formula.